There are under three months left to take advantage of the UK government’s super-deduction tax break on automation machinery.

Despite calls from industry leaders for the incentive to be extended, the Chancellor confirmed it will end as planned on March 31 2023, making this your last chance to qualify for the 130% capital allowance deduction.

What is the super-deduction incentive?

Under the scheme, which began in April 2021, any investments a business makes in main rate plant and machinery are eligible for a 130% capital allowance deduction, compared to the usual rate of just 18%. That means 25p off your company’s tax bill for every pound you spend on qualifying equipment, with no upper spend limit.

How does it work?

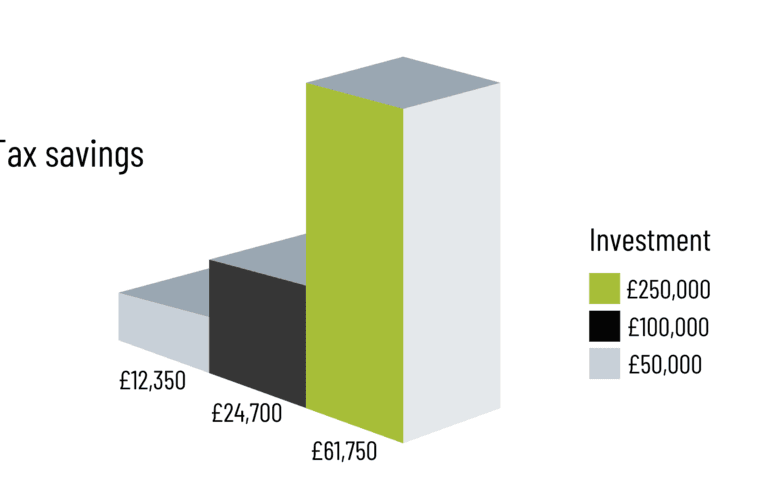

If your business spends £100,000 on qualifying automation machinery, when you come to calculate your taxable profits you can deduct £130,000 – 130% of your investment. Taking this off your taxable profits reduces your tax liability by up to 19% (£24,700), thus reducing your corporation tax by the same amount.

Equipment must be new and only companies are eligible, not partnerships, sole traders or individuals. However, the super-deduction can be claimed against machinery bought using hire purchase or similar financial agreements where ownership ultimately passes to the purchaser.

For full details of the qualification requirements and exactly how you could benefit we recommend you speak to your company accountant, who will be able to give you specialist advice tailored to your circumstances.

The wider benefits

The super-deduction incentive was introduced to encourage companies to invest in plant and machinery to boost productivity, aid the UK’s economic recovery in the wake of the Covid-19 pandemic and help UK businesses to compete on a global stage.

And with the UK falling behind when it comes to the use of robots in manufacturing, this push towards automation is much-needed. According to the latest International Federation of Robots (IFR) World Robotics Report, just 0.4% of the 517,385 robots installed in factories worldwide were in the UK and while global installations increased by 31% year-on-year, on home turf they were down by 7%.

Nevertheless, interest and investment in robotics are still growing, driven by the increased flexibility, cost savings and greater efficiency that automation can deliver. More and more manufacturers are seeing how adding machines from palletisers to handling systems to their production lines has the potential to transform their operations for the better – and the super-deduction tax break has been a further incentive.

It’s expected that the number of installations will continue to rise into the new year with those who invest before the deadline future-proofing their business and gaining a clear competitive advantage.