There’s never been a better time to invest in upgrading your machinery. From April 2021 until March 2023, the UK government is offering 130% capital tax allowance deduction on qualifying first-year plant and machinery purchases.

Usually qualifying for just 18% relief, in practical terms, the super-deduction of 130% means that the UK government is offering 25p off your company’s tax bill for every pound you spend on qualifying plant and machinery, with no upper spend limit. In addition to this, the government is offering the Annual Investment Allowance (AIA), which provides 100% relief for plant and machinery investments up to £1 million threshold (its highest ever), until 31 December 2021.

Why offer these incentives?

The driving factor is to make the UK more competitive internationally, with an aim of lifting the value of the country’s plant and machinery from 30th in the Organisation for Economic Co-operation and Development (OECD) to first place.

It will encourage companies who are considering investing in new plant or machinery to do so in the next two years. It’s expected that UK investment will be boosted by £20 billion a year.

Business investment has fallen since the start of the Covid-19 pandemic, but even without this, productivity growth has been slowing since 2008. The government is hoping that offering these generous incentives will stimulate business investment to promote economic growth.

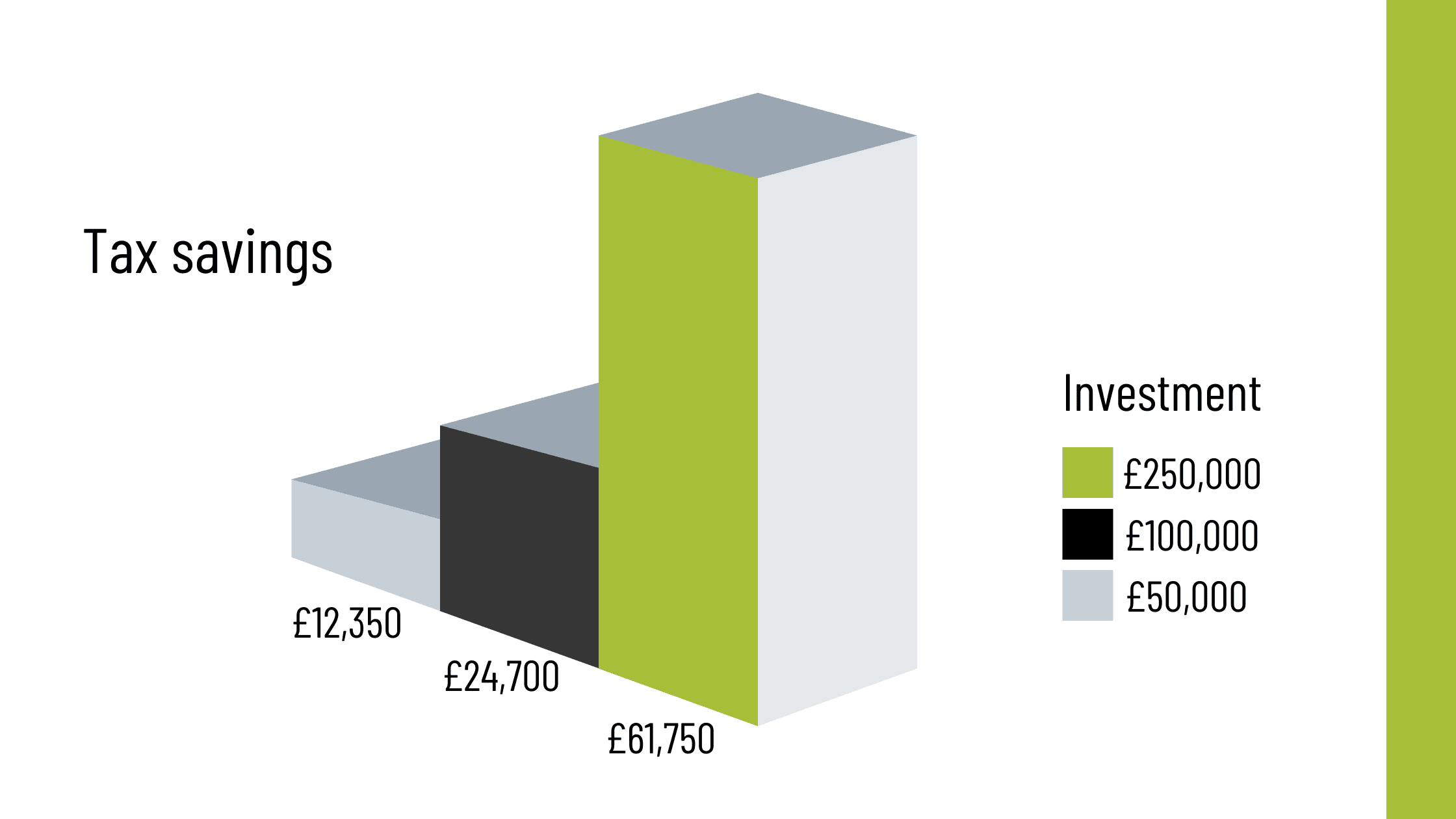

Example calculation

As an example, if you spend £50,000 on qualifying automation machinery and decide to claim the super-deduction, it means you can deduct £65,000 when calculating your taxable profits. This will save you up to 19% of that (£12,350) on your corporation tax bill.

Super-deduction on automation equipment

Some PALpack customers are already taking advantage of the super-deduction incentive scheme. The circumstances of the purchaser and equipment would have a bearing on whether or not the expenditure will meet the qualification rules. We recommend speaking to your company accountant for specialist tax advice to see how these incentives can work in your circumstances and ensure that you meet the qualification requirements. For full information on the temporary tax relief incentives, please visit gov.uk.

We’ve written before about the UK falling behind in innovation in recent years when compared to the other G7 countries and being left behind. At PALpack, we’re excited that the government recognises the role that business investment will play in moving the country’s industry forward in the next few years, enough to offer generous incentives to drive it. Implementing automation technology such as Automated Guided Vehicles (AGVs) and palletisers will drive business growth, improve speed and efficiency of production processes and future-proof your operations. Please get in touch for advice on the equipment that will best suit your business needs.