If you want to reap the rewards of automation technology in the next financial year, then now is the time to put together a budget for it. Automation budgeting may not be as exciting as the technology itself, but it’s a necessary business task. It’s also an ideal opportunity to demonstrate how automation can reduce your operating costs and improve profitability – and with this in place, your budget is more likely to be approved.

How to budget for automation

If this is the first time you’ve invested in automation, then start by assigning a lead person. It will be their job to keep the project on track and act as a point of contact.

Their first task should be to identify the pinch points in your manufacturing processes that could benefit from automation. They should also look at the associated costs of each area because you’ll need to include a cost-benefit analysis in your budget.

Once you have a list of priority areas, find a provider that can suggest suitable automation solutions to meet your requirements. At this point you can start to gather quotes for the machinery and installation to flesh out the estimates in your budget.

Read our blog on choosing an automation supplier for help finding a provider.

Calculating your cost savings

To demonstrate the benefits of automation, consider where you could make savings:

- labour costs

- staff injuries (sick days and injury payouts)

- line efficiency – time and output

- correcting mistakes

Keep in mind that some costs are non-financial, so it’s worthwhile taking a company-wide approach to your automation budgeting. Staff wellbeing, for example, can affect your reputation as a business, and it spills over into the work of human resources.

Drawing up a cost/benefit analysis will help you to work out the payback period for your new equipment – in other words, how long will it take for you to see a return on your investment?

With reduced labour costs and increased productivity, the payback period on some automation equipment (automated guided vehicles, for example) is less than a year.

Help to make capital investments

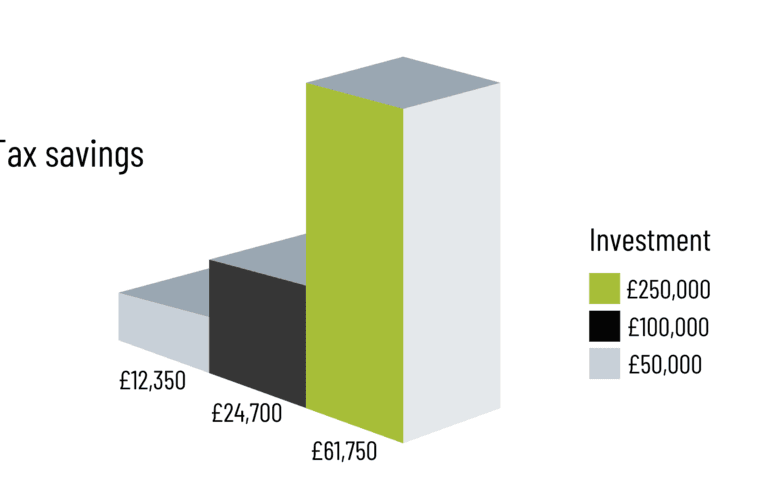

The UK government has launched a new initiative to help businesses cover the cost of qualifying plant and machinery. As part of the ‘super-deduction incentive‘, you can offset 130% of your automation equipment against your tax bill until the end of March 2023.

In practice this means for every £1 you invest, you can expect to save 25p in tax.

As an example, if you spend £50,000 on machinery, you can deduct £65,000 when calculating your taxable profits – saving you up to £12,350 on your final tax bill.

For more information on eligibility, speak to your business tax accountant, or visit gov.uk to check the qualification requirements online.

Automation budgeting – the bottom line

When it comes to automation budgeting, we recommend you look at cost savings and profitability rather than making expenditure the main focus. Including these financial projections in your budget is a solid way of justifying the expense of new equipment.

If you need help finding an automation solution that fits your business and your budget, we can help. PALpack is the UK’s leading expert in palletising systems, and an agent for some of Europe’s best manufacturers.